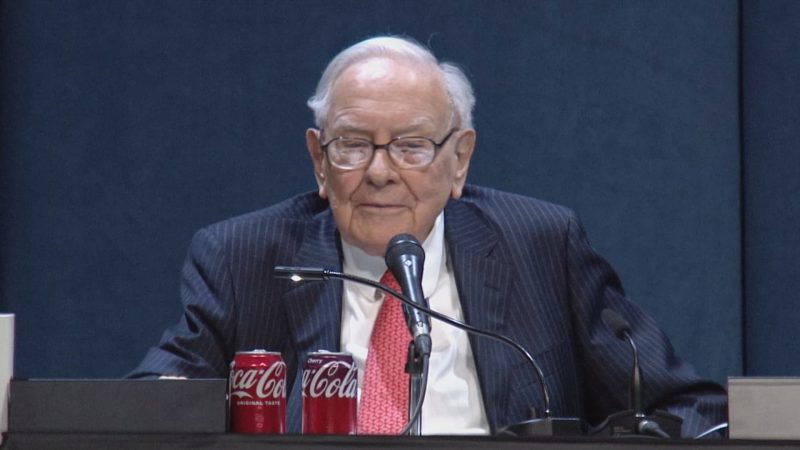

Warren Buffett Shares Key Investment Lessons at the 2025 Berkshire Shareholder Meeting

Warren Buffett walked into the 2025 Berkshire Hathaway Shareholder Meeting with the same calm he has carried through decades of market chaos. When someone asked if recent market jitters had created buying opportunities, Buffett didn’t flinch. His answer? Not really.

The past few months have been wild. Inflation fears, trade war whispers, and unpredictable policy moves have thrown markets into a spin. But the Oracle of Omaha, 94, is not buying the panic. According to him, this wasn’t even close to the kind of fear that brings real opportunity.

This Is Just Noise, Not a Crisis

Warren Buffett has seen worse. Way worse. He reminded everyone that the Great Depression saw the Dow go from 381 to 42. That is the kind of crash that changes your blood pressure. By comparison, today’s drop is just noise.

The News / Don’t confuse short-term drama with real danger. Investors love to react fast. But Buffett’s take was simple.

If your heart rate jumps when the market drops 15%, you need a different strategy.

Volatility Comes With the Territory

Markets move. They always have. And Warren Buffett has ridden the wave through all of it. In over 70 years of investing, he has had front-row seats to more than a few gut-wrenching slides. So, what has the Oracle of Omaha learned? Volatility is not a crisis. It is just part of the game.

Buffett warned that if you are investing with a short fuse, you are playing the wrong game. Stocks don’t rise in straight lines. And when they fall, they don’t ask permission first. The real question is: Can you stay cool when everyone else panics?

Focus Long-Term Like Buffett Does

Warren Buffett didn’t build Berkshire Hathaway into a powerhouse by chasing hot tips or trying to outguess the headlines. He stayed the course even when it got weird and even when it got ugly. That is the lesson.

Short-term fear is loud. It fills headlines and dominates Twitter. But it rarely builds wealth. Buffett’s focus is always forward. Five, ten, twenty years ahead. That is how he thinks. And that is how you should think.

Bigger Shocks Will Come!

He wasn’t sugarcoating anything either. “You will see a period in the next 20 years that will be a ‘hair curler,’” Buffett said. He didn’t say “might,” instead he said “will.” Big market shocks are scheduled surprises. And yet, every time, markets have eventually clawed back and hit new highs.

MSN / Warren Buffett believes real investors don’t try to time these swings. They prepare for them. They keep buying, holding, and don’t blink.

That is where Buffett’s favorite approach comes in: Consistency. Buying regularly, no matter what the market is doing, means you avoid the trap of trying to guess the best moment. It is called ‘dollar-cost averaging,’ and it works.

When stocks drop, you are buying more for less. When prices rise, you are buying less, but your earlier shares are gaining. Over time, the cost balances out. This strategy is built for storms and for patience.

Forget Timing, Build a Plan Instead

If you are asking whether now is the time to jump in or get out, you are already one step behind. Buffett’s advice? Don’t base decisions on market moods. Build a plan. Stick to it. Let time do the heavy lifting.

One of the best parts of Warren Buffett’s wisdom is how boring it sounds, because boring works. You won’t hear him hyping crypto, chasing the next AI moonshot, or sweating over every tweet that moves a stock price. He bets on strong companies, held for the long haul, with a cushion of cash for storms.

More in Money

-

`

Do Students Actually Learn Anything in School?

Mindfulness is now a regular part of school life for over a million students in the U.S. It promises to help...

August 29, 2025 -

`

“The Walking Dead” Actress Kelly Mack Dies at Just 33

At only 33, actress Kelly Mack has died, leaving behind grieving fans and friends in the film community. Best known for...

August 23, 2025 -

`

How to Market Your Tech Business for Billion-Dollar Growth in Dubai

Dubai’s business scene is exploding at a rapid pace. With a tech ecosystem valued at $43 billion in 2025 and ten...

August 15, 2025 -

`

Michelle Obama’s ‘Parenting Wisdom’ Earns Her a Next Gen Award

Michelle Obama is being recognized for what millions already admire her for: keeping it real, especially when it comes to parenting....

August 10, 2025 -

`

How to Make Good Habits Stick For Long? 5 Practical Tips

Good habits can change your life, but keeping them alive is the real challenge. Many people start strong and then slowly...

August 3, 2025 -

`

How A Family Crisis Pushed Brad Pitt to Quit Drinking

Brad Pitt hit a wall in 2016. The actor, known for his cool demeanor and A-list charm, found himself in the...

July 27, 2025 -

`

This New York-Based Startup Has Cool Ways of Quitting Cigarettes, Vaping & Zyn

Quitting cigarettes, vaping, and Zyn has always felt clinical, awkward, and kind of lame. But Jones, a New York-based startup, is...

July 18, 2025 -

`

Inside Gwen Stefani’s Life With Her “Greatest Love” Blake Shelton

Gwen Stefani kicked off Blake Shelton’s 49th birthday in the most personal way possible. On June 18, 2025, she shared a...

July 11, 2025 -

`

What Is the Science Behind Out-of-Body Experiences (OBEs)?

Out-of-body experiences, or OBEs, sound like science fiction. But they are real, at least to those who experience them. OBEs involve...

July 5, 2025

You must be logged in to post a comment Login